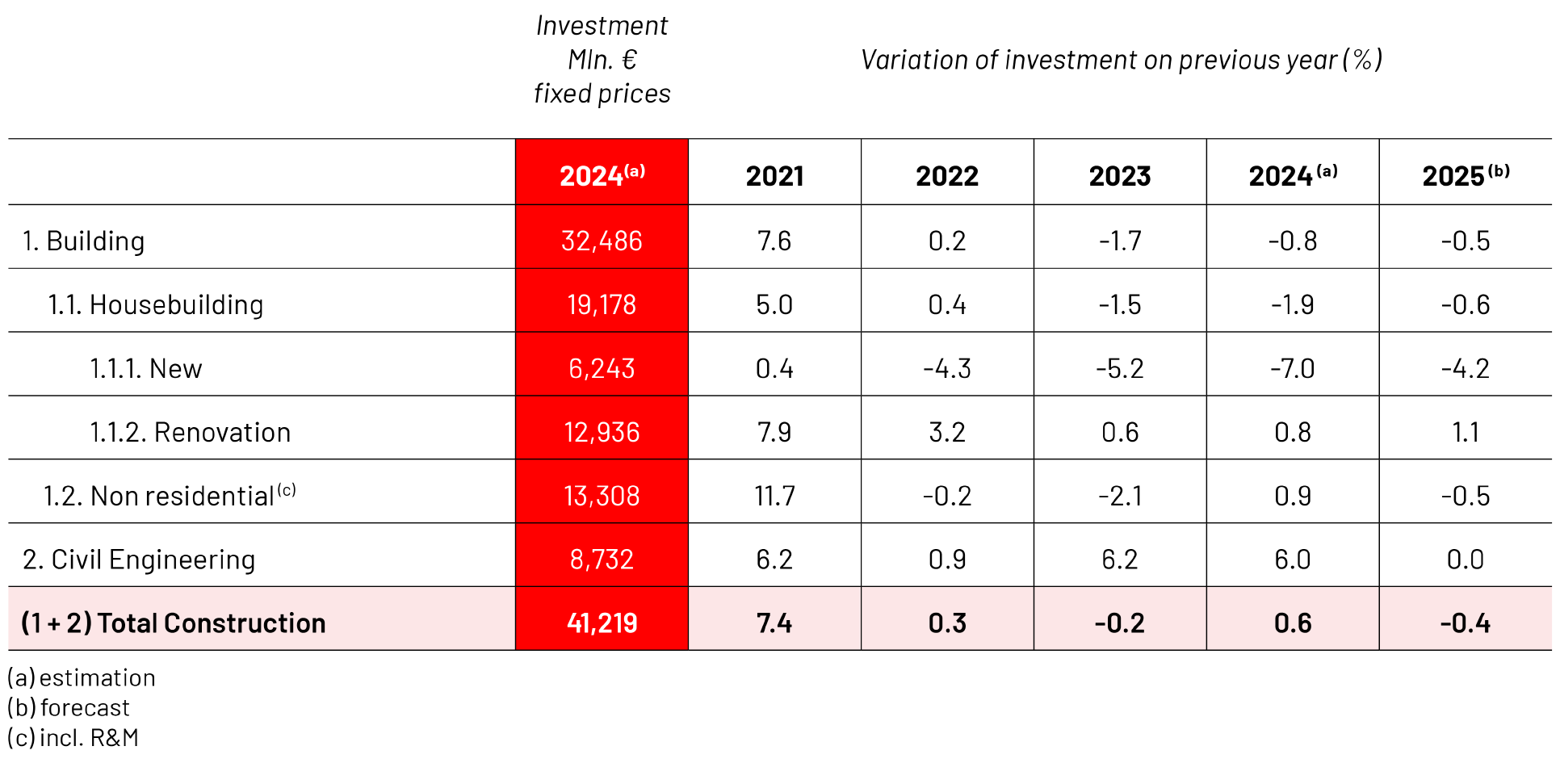

Overall construction activity

Overall, construction is likely to have increased slightly in 2024 (+0.5%). This is despite the difficulties related to the level of costs and interest rates, both of which have still strongly affected the residential sector.

Material prices and interest rates, which remain high in a less favourable overall economic context than in 2024, do not allow us to envisage a recovery in 2025. The sharp decline in building permits recorded in 2024 will continue to weigh on activity for new housing.

Stimulus plans, investments by local authorities and some major infrastructure projects have had a positive effect in 2024. Taken as a whole, however, they are no longer expected to support growth in 2025.

In total, a decline is expected for construction in 2025 (-0.4%).

Housebuilding

New residential construction falls sharply in 2023 (-7%), taking into account the significant decline in the number of dwellings approved. This decline (-10% in 2022), largely due to the rise in construction costs and interest rates, continued in 2023 (-7%) but seems to have come to an end, with some recovery expected in 2024. However, given the lead times for both building starts and construction, this will not be enough to bring about a recovery in activity from 2024 onwards. The volume of work in progress in 2024 will be heavily influenced by the number of dwellings approved in 2023 (which will be much lower than in 2022). As a result, activity is expected to fall by a further 5% or so.

Activity in the housing renovation sector continues to grow in 2023 (+1.0%). A final boost from the stimulus packages and the introduction of an energy renovation obligation in Flanders have more than offset the difficulties related to prices and interest rates in 2023, as well as the impact of the reduction in reconstruction work. In 2024, the economy should return to stronger growth (+1.6%) in a context where price and interest rate developments are expected to be more favourable.

Residential construction

Activity related to the construction of new housing experienced a further significant decline in 2024 (-7%), given the significant decline in the number of housing units authorised, which continues to fall. Largely due to the rise in construction costs and interest rates in 2022, this decline (by almost 30% between 2022 and 2024) is likely to continue somewhat further in 2025 for at least two reasons. On the one hand, because the monthly profile has remained bearish throughout 2025 and on the other hand, because the economic environment does not have the springs to generate a rebound in demand. As a result, activity is expected to decline by around 4% in 2025.

Activity in the housing renovation sector continued to grow in 2024 (+0.8%). A latest ramp-up of the recovery plans and the work related to the recent energy renovation obligation in Flanders have more than compensated for the persistent difficulties related to the level of construction costs and interest rates in 2024. Housing renovation is expected to continue to grow in 2025, but still weakly. While the difficulties related to construction costs and interest rates should weigh a little less (as for new housing), the work related to different stimulus should no longer support growth.

Non-residential construction

Non-residential renovation, supported in particular by its own momentum and the ramp-up of stimulus plans, grew by 1.1% in 2024. In 2025, however, it is expected to decline (-1%), in particular due to the gradual completion of the recovery plans and a lower volume of work related to the renovation plan for Walloon hospitals.

New non-residential buildings seem to be seeing the end of a period of decline, with an increase of around 0.7% in 2024, following the increase in building permits issued previously. However, a real recovery is not expected in 2025 but rather a stabilisation. The effects of the decrease in the volume of new buildings authorised in 2024 should be offset by the fact that the mix of buildings that were authorised then generates more work than it was for 2024.

GDP 2024

BILLION

POPULATION 2024

Total investment in construction in 2024

BILLION

Civil engineering

It is estimated that civil engineering grew by 6% in 2025, thanks to the combination of two factors favourable to activity in this segment. The effects of the recovery plans and the intensification of municipal investments in the run-up to the local elections in October 2024. They more than compensated for the decreases recorded for certain types of work, such as those related to major infrastructure projects that suffered from the completion of the Liège tram project.

The total volume of work related to the main specific infrastructure projects is expected to increase significantly in 2025. Conversely, local government investment is expected to decline quite significantly and the recovery plans are not expected to generate as much work as in 2024. The level of civil engineering activity should therefore, a priori, remain stable in 2025, provided, however, that the projects that will allow this stabilisation do not fall behind.

Prices of construction materials

After the previous sharp increases, material prices have largely stabilised (at a high level) since the beginning of 2023. On average, they increased by 1% in 2024.

However, this average trend hides important differences between the development of the various building materials. Some of them, such as wood, metals and plastics, are now cheaper than in 2022. Others, such as gravel, bricks and cement, are, on the other hand, more expensive than at the time.

The figures for the first two months known at the time of writing this article tend to indicate the continued stabilization of the average level of material prices. This trend will obviously have to be confirmed during the year.

Editorial office closed on 25 April 2025

Construction activity

Number of building permits in residential construction