Overall construction activity

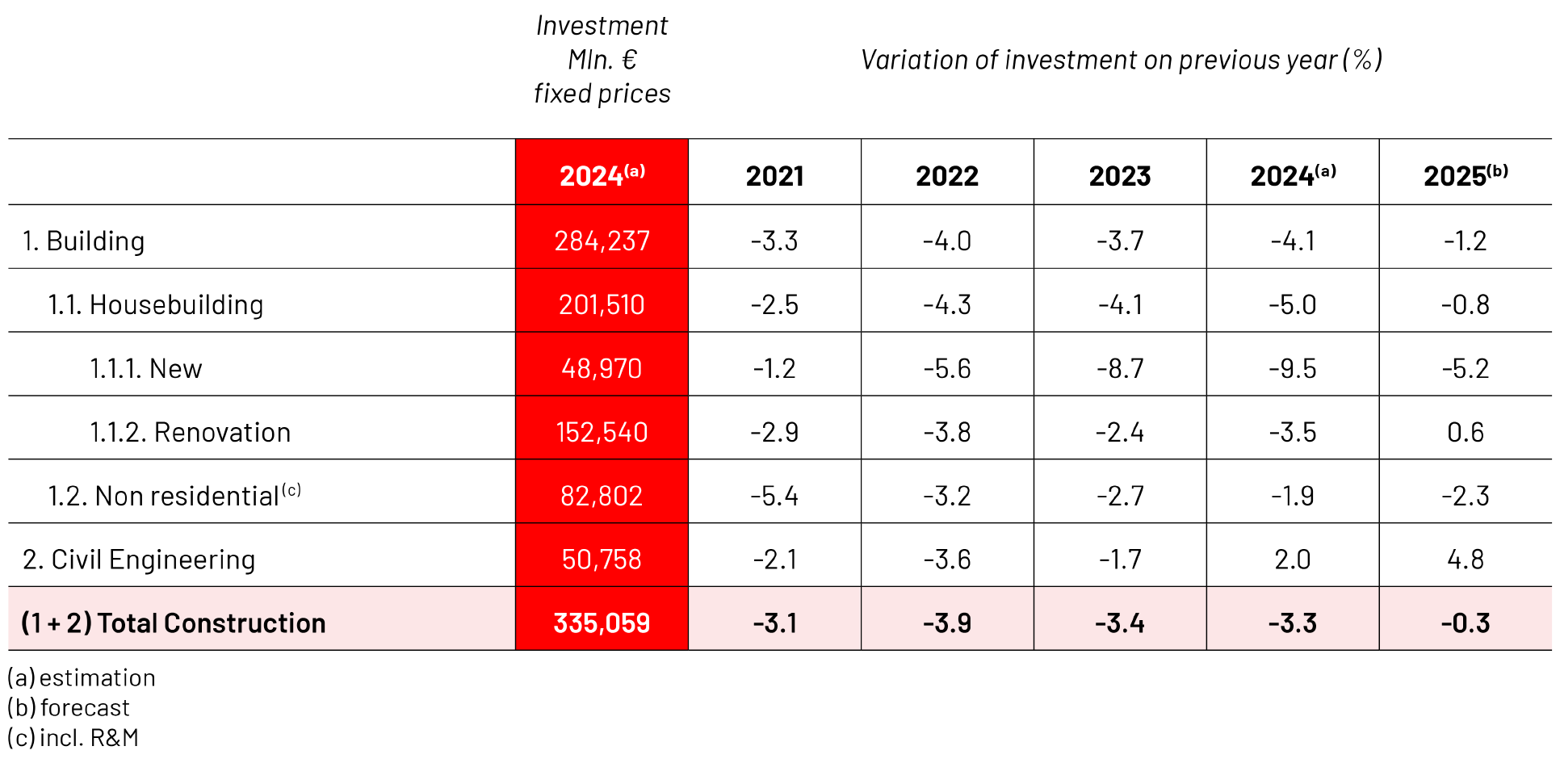

2024 was the fourth year of a weak phase in the construction sector in Germany. While real gross domestic product decreased by 0.2 %, construction investment fell by 3.3 % on a price-adjusted basis. This was the fourth consecutive year of decline. The upward trend of the construction labour market – that began in 2009 and was only interrupted in 2015 – came to an end with a decline of 28.000 employees (-1.1%) to 2.6 million.

While construction output was severely restricted in previous years due to construction material shortages, this was no longer the case in 2024. At the beginning of 2023, 13 % of construction companies reported production restrictions due to a shortage of materials, but by the end of 2024 this figure had fallen to just 1 %. Similarly low figures are expected for 2025.

For months, prices only headed in one direction: upwards. Since July 2022, however, a price stabilization has been observed for some materials, but this has not fully offset the previous increase. There was a mixed trend in construction material prices. Since 2023, the producer price indices for bitumen and cement have been at a higher level than the price indices for steel and wood. During the last years, energy-intensive materials have become particularly more expensive.

Due to the settling down of prices for construction materials and the current high level of prices for construction services, the average price increase for 2023 was 7.4% and 2.5% in 2024. For the current year, the prices are likely to increase by 2.3 %.

In a survey at the beginning of 2025, 55 % of construction companies identified energy and raw material prices as a risk for their company. The demand for construction services was stated by 62 %, followed by the shortage of skilled workers at 56 % and the level of labour costs at 52 %. As in the previous years, 59 % of construction companies are particularly concerned about the economic policy environment and labour costs.

The earnings, which have improved continuously until 2020, have deteriorated since then. Both the returns and equity ratio have declined. As a result, the number of insolvencies in the construction sector increased by 12 % in 2022 and 2023 and by 19 % in 2024.

Incoming orders in the construction industry showed a markedly different trend in 2024. Overall, price-adjusted order activity decreased by 0.7 %. An increase of 3.4 % in civil engineering contrasts with a decline of 5.0 % in building construction, which is mainly due to a 3.5 % drop in orders in residential construction in 2024 - after a slump of almost 20 % in 2023. Therefore, new residential construction remains the biggest problem the German construction industry is facing.

Expectations for 2025 are slightly negative in the construction industry. Construction investment is likely to fall by a further 0.3 % in real terms overall, although the trend in the separate construction sectors will vary considerably. The number of employees is expected to shrink and the number of people in employment is also expected to fall compared to the previous level in 2024.

Housebuilding

With a 60 % share of total construction investment, residential construction dominates the construction sector in Germany. Its extremely weak performance is therefore having a particularly strong impact on the overall construction market. While investment in existing housing is likely to remain stable in 2025 due to a variety of government subsidy measures, a further decline in new residential construction is to be expected.

Two factors are having a negative impact. Firstly, interest rates for mortgage loans have risen from 1.3 % to over 4 % in just two years. This has made the refinancing of residential construction investments more expensive. In 2023, the volume of new residential construction loans to private households fell by EUR 96 billion or 44 %. From November 2023 to December 2024, however, interest rates fell by an average of 0.49 percentage points regarding all maturities. The new business volume of residential construction loans increased by 23.1 % in 2024 compared to the previous year.

At the same time, construction prices have risen by around a third compared to the end of 2021 mainly due to increased costs in materials. Many private households cannot afford residential property on these terms.

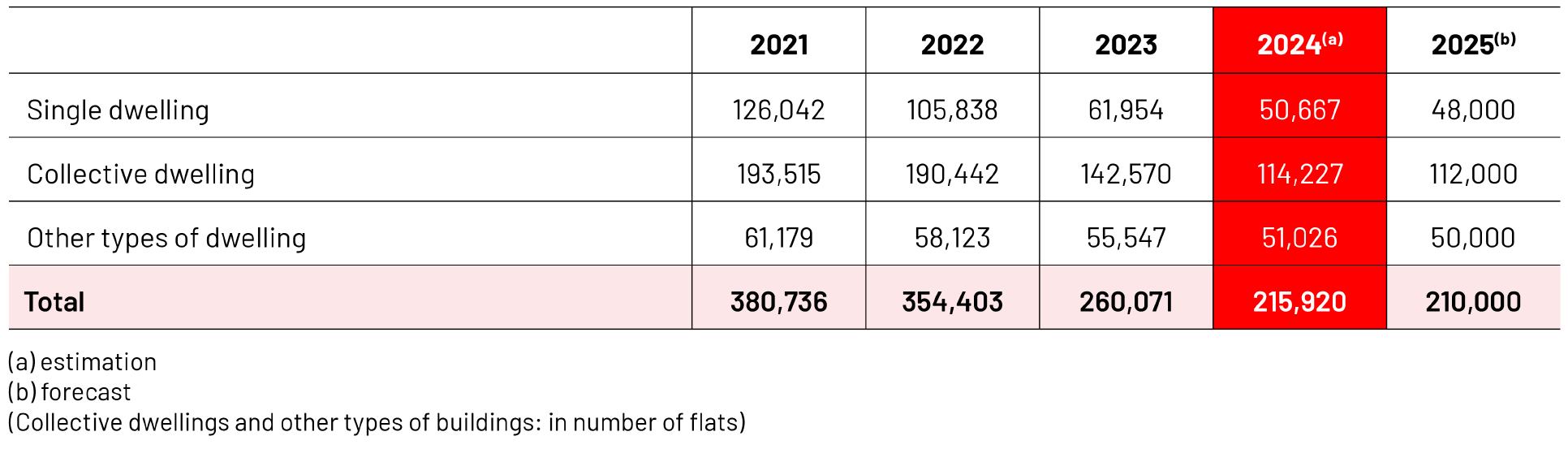

This is also reflected in the number of building permits, which fell by 27 % in 2023, which was the sharpest decline since 2007, followed by a decline of 17 % in 2024. While the number of dwellings approved in apartment buildings fell by 20 %, the decline in building permits for detached and semi-detached houses was 18 %. While the German government set a target of 400,000 new housing units per year, 294,000 homes have been completed in 2023. In 2024 only 215,000 apartments have been permitted. Therefore, the number of permits is below the level of 2011.

Although the government has adopted several support measures in favour of new residential construction (subsidies for climate-efficient new buildings, better depreciation conditions), these are nowhere near enough to lure investors back into the market. This is also reflected in the order backlog. The order backlog has fallen from its peak of 6.0 months in February 2022 to 3.1 months in October 2024, the lowest figure since 2016. At the current margin, the range of orders is slightly increasing again.

The government has set the goal of making the building stock in Germany climate-neutral by 2045. To achieve this, investment in energy-efficient renovation must be significantly increased. Therefore, it is to be expected in the medium term this sector will increase more than new construction.

Non-residential construction

80% of non-residential building construction is accounted for by the commercial sector. The ongoing weakness of the German economy has left its mark on new construction during the last two years, both in terms of approvals and incoming orders. Many investors - especially in industry - are withholding their investment plans due to the weak economy and current developments in trade policy. After a price-adjusted 10 % decline in orders in 2023, incoming orders fell by 8 % in 2024. Expectations for the current year are slightly more positive in commercial building construction than in public building construction. Driven by several major projects, incoming orders in public building construction rose significantly in 2023, followed by a drop of 5 % (price-adjusted) in 2024.

A stable trend is expected in the energy-efficient refurbishment of existing buildings. As energy prices remain at a high level, refurbishment measures are more profitable in the long term. There is also increasing political pressure to make the building stock climate-neutral by 2045.

GDP 2024

BILLION

POPULATION 2024

Total investment in construction in 2024

BILLION

Civil engineering

This sector is dominated by the public sector, which accounts for around 80 % of investment in civil engineering. After years of neglecting transport networks, a turnaround can now be seen on the market. This is clearly reflected in the previous year's order intake. Civil engineering saw an increase of 3.4 % in both 2023 and 2024 on a price-adjusted basis due to several major projects in railroad and cable line construction. Deutsche Bahn AG in particular, which is receiving considerably more money for investments from the federal government, placed several large orders. But major projects in civil engineering were not able to offset the declines in residential commercial and public building construction in 2024. In the public sector, orders for road construction stagnated in real terms. Investment in other civil engineering measures (underground railway construction) increased by 4,8 %.

In public construction, there were partial cancellations of orders in 2024 as well as an extension of the construction programme at Autobahn GmbH. The 500 billion Euro infrastructure fund for additional investments over 12 years - including 100 billion Euro to cover climate-protection initiatives – is expected to create a positive impact due to improved planning reliability. Only by commissioning large, medium and small orders all construction companies will be involved in this major task.

Prices of construction materials

The shortage of construction materials, which dominated the market in 2022, receded more and more into the background in 2023. At the beginning of the year, 13% of construction companies reported production restrictions due to material shortages, but by the end of the year this figure had fallen to just 2%. Similarly low figures are expected for 2024.

Construction material prices showed a mixed trend. At the end of the year, producer price indices for reinforcing steel, timber, glass and insulation boards were in some cases relatively significantly lower than in January. There were price increases (bitumen, cement, concrete), particularly for products that require a lot of energy to produce and whose prices are still very high by European standards.

In residential construction, this has led to a trend towards greater use of wood as a building material. Above all, wood is seen as more environmentally friendly. Both the energy used in production and CO2 emissions are minimised.

Construction activity.

Number of building permits in residential construction