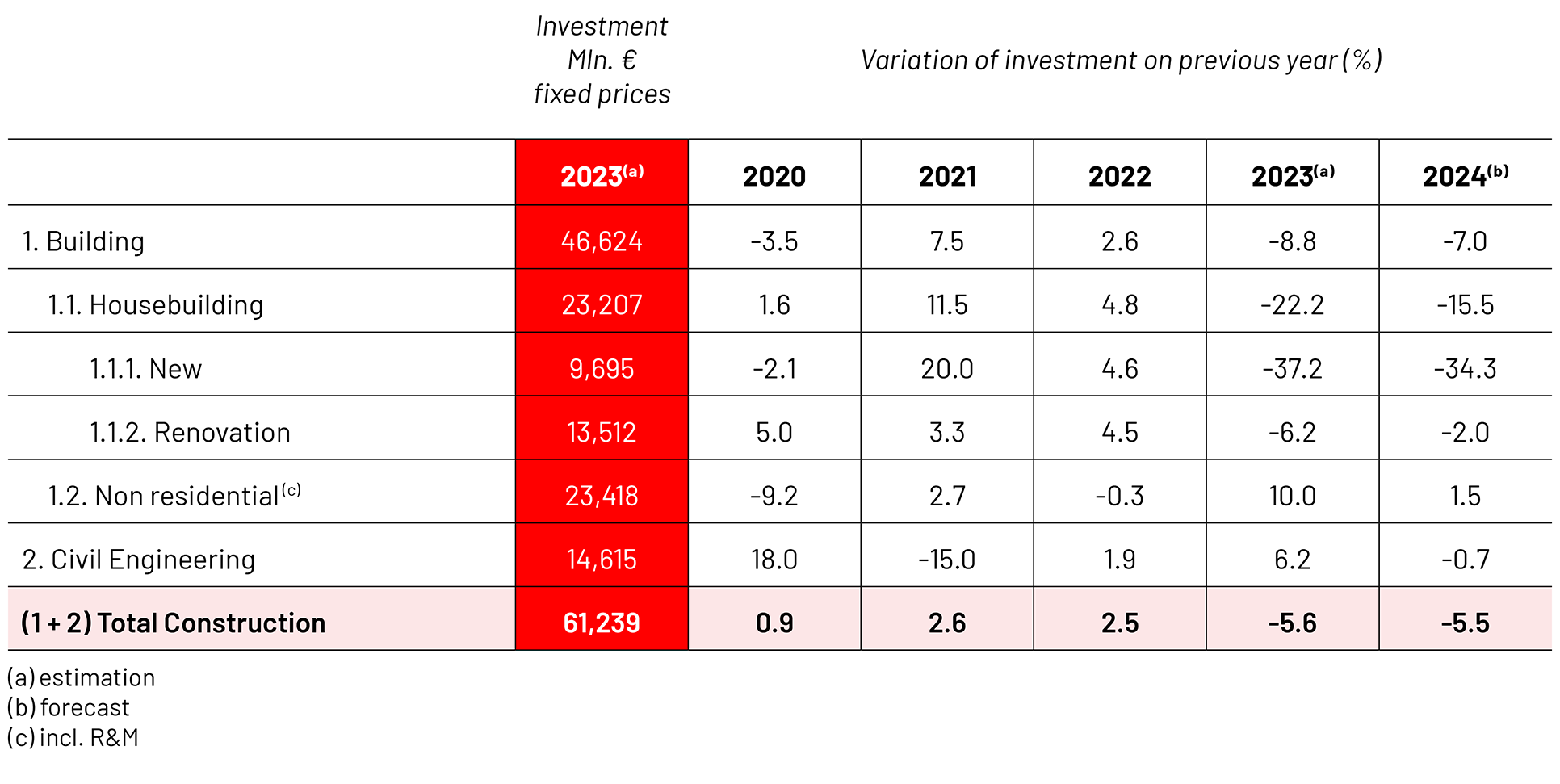

Overall construction activity

Falling global inflation means that central banks will start to ease monetary policy later in the year, allowing the global economy to pick up speed in 2025. However, the Swedish economy will continue to be held back this year by the ongoing decline in residential investment. Next year, however, the recovery will be stronger as interest rates have fallen and the construction sector will again make a positive contribution to GDP growth. For the construction industry, the expansion of non-residential investment will dampen the negative effects of the slowdown in the residential and civil engineering sectors this year. Next year, however, construction investment will grow much faster than the economy as a whole, thanks to growth in all construction sub-sectors.

Overall, construction investment falls by just over 1 per cent over the forecast period, mainly as a result of the sharp decline in residential construction. The fall in investment leads to a fall in construction employment in that year, but this is reversed the following year and employment rises slightly as construction resumes growth in all sub-sectors. Overall, employment falls by just over 1 per cent, or almost 2,600 people, between 2023 and 2025.

Housebuilding

Residential construction, which began to decline in 2022, will continue to fall this year. Falling house prices, rising interest rates, higher construction costs, lower real disposable incomes and the removal of investment subsidies for the rental housing market have driven the decline over this period. Next year, the decline in new construction could turn into a slight uptrend as interest rates start to fall, house prices start to rise and real incomes start to increase. Overall, investment in new construction will fall sharply this year (-34 per cent), but will turn upward next year, rising by 12 per cent. Renovation, which fell last year, will stabilise this year. Next year, investment will pick up again with the help of interest rate cuts by the Swedish central bank and a more subdued development in material prices.

Non-residential construction

Non-residential investment, which grew by 10 per cent last year, will continue to grow throughout the forecast period. This year, government investment in defence and criminal justice will be the main driver. Next year, the private sector will also make a positive contribution as the commercial property sector picks up. In addition, the manufacturing sector continues to invest heavily in new factories, with much of the volume related to the green transition.

GDP 2023

BILLION

POPULATION 2023

Total investment in construction in 2023

BILLION

Civil engineering

Civil engineering investment, which grew by 6 per cent last year, will decline this year due to reduced public infrastructure construction. The private civil engineering market will grow throughout the forecast period, driven mainly by an upturn in the energy sector. The following year, when the public sector increases its investment, total infrastructure investment will rise.

Prices of construction materials

The price of building materials has gradually slowed down since its peak in the summer of 2022, when the annual rate of increase for residential building materials was 25 per cent. The annual rate has now fallen to 1.4 per cent and the materials with the highest annual rate are now electrical materials and white goods. Other materials, such as wood and steel products, have fallen in price since the peak in 2022.

Per cent variation of investment in real terms of previous year

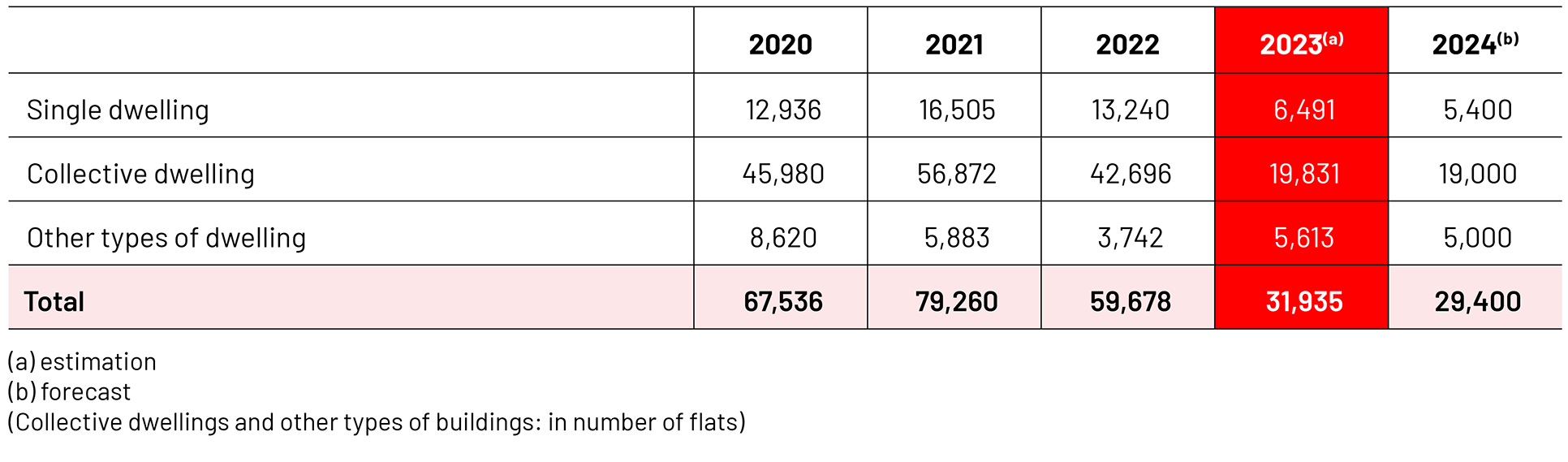

Number of building permits in residential construction