Overall construction activity

While the expansion of Ireland’s economic activity in is set to continue in 2025 and 2026, the overall pace of growth is projected to slow amid heightened global uncertainty. At the start of 2025, the Irish economy was in a strong position with full employment. A significant deterioration in global trading conditions towards the end of Quarter 1 will almost certainly have adverse implications for the domestic economy. Current forecasts for Modified Domestic Demand growth in 2025 vary from 2.7% (Central Bank) to 2.1% (ESRI). MDD is forecast to grow by 2.4% per annum on average in 2026 and 2027.

Ireland, as a small open economy, is facing into a period of slower, steady growth over the medium term. Current forecasts for the domestic economy from the Central Bank of Ireland point to the shift in policy weighing on the outlook for consumption, investment and exports, and leads to the slower growth now expected compared to the Quarter 4, 2024 forecast period.

In the interim, cyclical conditions are easing, with a greater balance between labour demand and labour supply becoming evident. In the short-term steady employment growth is forecast alongside growth in wages consistent with productivity developments across the economy.

Continued underinvestment in housing and infrastructure is a growing constraint on economic growth. In 2024, construction investment continued to remain weak. Overall, investment in building and construction declined by just under 3% in 2024 compared to the previous year. The construction sector declined by 1.8% year-on-year in 2024 compared with the previous year in terms of Gross Value Added.

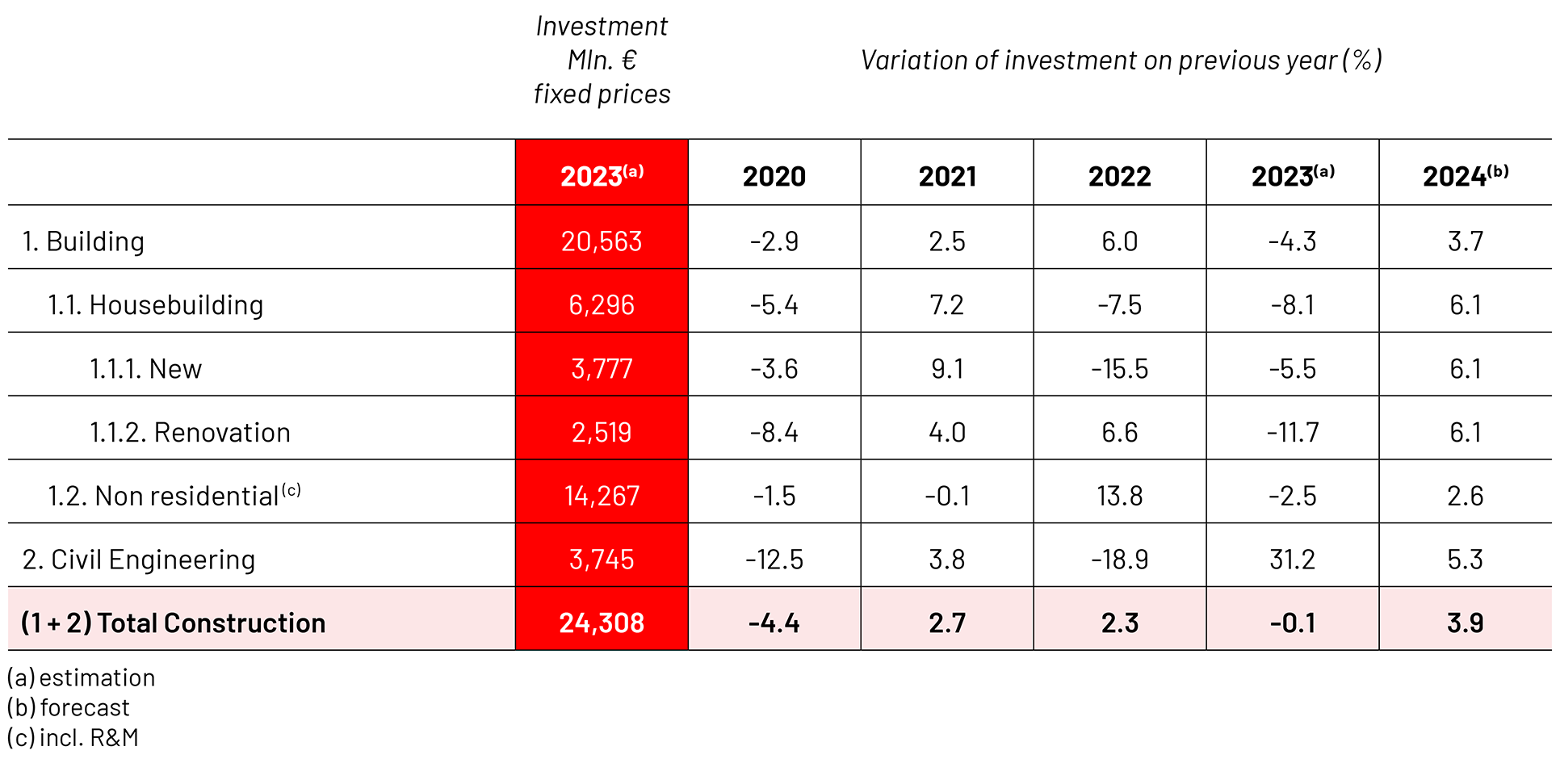

EY/Euroconstruct issued a revised Irish construction growth forecast in December 2024. The sector is projected to grow by 1.4% in 2024 and 6.0% in 2025.

Excluding residential construction, output in the remainder of the construction industry (i.e. non-residential construction) is expected to increase by 3.3% in 2024 but growth is forecast to moderate to 0.8% in 2025, due to pressure in the new office building.

Direct construction employment stands at 176,300 persons at the end of 2024. It is important to note that an increasing share of construction related employment is potentially captured by the manufacturing (off-site) data.

At a minimum, Irish society needs the construction industry to deliver at least 60,000 housing units annually. Ireland’s cities, provincial towns and regional communities require Irish construction companies to deliver billions of investments in critical, social and productive infrastructure under the National Development Plan to drive economic growth, competitiveness and environmental sustainability.

Capacity to deliver the necessary enabling infrastructure, as well as the quantity of zoned land, in areas where demand is highest remains a source of uncertainty for the construction sector. A significant pull factor for firms to re-orientate to residential construction may be determined by the commitment of government to address the blockages in the sector.

Continued underinvestment in housing and infrastructure is a growing constraint on economic growth. In 2024, construction investment continued to remain weak. Overall, investment in building and construction declined by just under 3% in 2024 compared to the previous year.

Ireland’s demand for investment in critical infrastructure has reached beyond the existing capital ceilings, especially in water services, housing, transport and health for several years. All parties are familiar with the current capacity constraints of key portfolios. To ensure Ireland’s future economic competitiveness, we need a plan-led approach to infrastructure to ensure critical utilities can be delivered.

The CIF is working to address ongoing constraints to delivery across these critical infrastructural areas.

Housebuilding

Ireland faces an urgent housing crisis, requiring immediate intervention through financial

support, regulatory reform, and strategic planning. The industry has identified several key financial mechanisms and policy changes required to stimulate housing production and ensure long-term sustainability. All stakeholders need to work to mitigate barriers to development, expedite planning processes, and incentivise investment to meet the state’s ambitious target of

50,500 homes per annum. The industry is focusing on five critical enablers:

- Planning Interventions

- Financial Enablers

- Infrastructure Delivery, incl. the establishment of a Strategic Housing Activation Unit as a coordination vehicle

- Modern Methods of Construction (MMC) & Productivity

- Public Procurement Strategy

In terms of housing delivery, a complex planning and building regulatory environment, alongside issues relating to the specifications of units, is adding to the cost of delivering housing.

The ongoing weakness in housing supply was characterised by a drop in residential investment in 2024 of 7.8% for the full year relative to 2023. Housing completions of just 30,300 units in 2024, alongside other infrastructural deficits, mean that housing costs will continue to escalate across the economy as demand grows.

The planning and regulatory environment is a major barrier to investment. Consequently, it takes longer and is more expensive to deliver housing and other major infrastructure projects in Ireland.

For 2024, there were 30,330 new home completions, 6.7% lower than 2023 and 9.3% lower than target. This consisted of 21,567 houses (+2.8%) and 8,763 apartments (-24.1%).

Planning permissions for 32,401 homes were granted in 2024, 21% lower than in 2023. Permissions for apartments decreased by 39%, while permissions for houses decreased by 2.7%.

69,060 new units were commenced in 2024 (+110.5% on 2023). While positive, the expiration of the development levy waiver and the Uisce Éireann rebate has reduced the accuracy of this metric as a guide to future delivery.

Historically, the relationship between planning permissions, commencements and completions in the Irish housing market was relatively stable. This is no longer the case because of the many blockages that exist in the system.

The retrenchment of institutional investment in the private rental sector (PRS) over recent years is now being borne out in the completions figures. It will be very difficult to meet official supply targets without a significant increase in such investment.

Non-residential construction

On the non-residential side, activity has not yet returned to pre-pandemic levels. Following some years of lower investment, likely driven by higher interest rates, changing work practices and excess supply of office space, investment in CRE began to recover towards the tail end of 2024.

This represents the first evidence of recovery and growth in this sector since 2022. In a cyclical and fragmented industry such as construction, the two factors: pipeline and funding are key to growth right across the construction supply chain.

On a seasonally adjusted basis, the volume of production in construction between Q4 2023 and Q4 2024 grew by 6.7%. During the same period, production volume in the Non-Residential Building sector rose by 9.2%.

These projections are also contingent on a pick-up in civil infrastructure projects forthcoming under the NDP.

GDP 2024

BILLION

POPULATION 2024

Total investment in construction in 2024

BILLION

Civil engineering

The civil engineering sector will continue to be the backbone of the wider construction sector as it is typically less prone to market fluctuations. The civil engineering sector is forecast to see strong growth of 4.5% in 2025. On an annual basis, between Q4 2023 and Q4 2024, production volume was up by 3.7% in the Civil Engineering sector.

With €14.9 billion in capital expenditure planned in 2025, it is intended that additional funding will be targeted at capital projects that are ready for development. The industry is calling on government to provide the necessary ringfenced funds of €500m per annum to fund the design and construction of capital projects in water and wastewater, and to drive delivery of transport infrastructure projects.

The National Development Plan is targeted for review in June 2025. The industry is calling for reform of the prioritisation process of capital projects in key agencies and the review of the Infrastructure Guidelines to reduce delays in decision making and embed value for money across all capital projects. Public investment under the National Development Plan remains an important stabiliser for construction demand and employment in the civil engineering sector.

A significant deficit in regional infrastructure from water to wastewater services, and from roads to rail, is impacting the ability of the regions to grow and become an economic counterbalance to Dublin, as envisaged by the National Planning Framework. A modern, dynamic, and competitive economy needs a plan led approach to infrastructure.

It is essential to Ireland’s success that energy, water, broadband, public transport, schools, hospitals, ports and roads infrastructure, through effective and efficient planning, are provided in a balanced but targeted regional basis, and under-pinned by a delivery model that is built on the principle of putting the necessary infrastructure in first.

Capacity constraints exist across Local Authorities, Regional Authorities and An Bord Pleanála – essential actors in the delivery of infrastructure. Planning at the local and regional level has a considerable impact on the progress of infrastructure plans.

The contracting environment has also given rise to a reduced appetite for involvement in public procurement and an adversarial nature which forces contractors to focus on contract management rather than project delivery.

Counter cyclical investment, the National Development Plan, procurement reform and the ongoing planning and design of critical infrastructure is essential to building a strong visible pipeline of work for the industry. This creates confidence in the future and certainty, which are critical factors supporting construction companies to invest in their people, technology, and processes.

Prices of construction materials

Prices of construction materials will continue to impact the competitiveness of the construction sector in Ireland in 2025.

Headline inflation has eased over the course of 2024. However, annual inflation in the wholesale prices of construction materials reached 1.0% over the 12 months to March 2025. The Building and Construction Index was also up by 2.1% in the 12 months to March 2025. This index combines the materials index with a measure of the change of wages in the construction sector to provide an overall index for input construction costs.

Significant increases continue in some construction materials:

Concrete Blocks & Bricks: +8.0%

Sand & Gravel: +7.7%

Other Structural Steel: +6.1%

Cement: +5.7%

The duration of inflation and high interest rates remains somewhat uncertain. Slower economic growth and diverging levels of inflation across European Member States will remain for the foreseeable.

Construction activity

Number of building permits in residential construction