Overall construction activity

According to the first estimates of the Statistical Office of the Republic of Slovenia, the Slovenian construction sector (Nace Rev. 2 - F) generated value added of EUR 3.7 billion in 2022, which is EUR 859 million more than in 2021. The real growth of value added in the construction industry was 10.4% (nominal growth: 30.4%). Value added in construction accounted for 7.1% of the total value added of all sectors of the economy in 2022 (6.2% in 2021), while in the EU-27 it is around 5.5%.

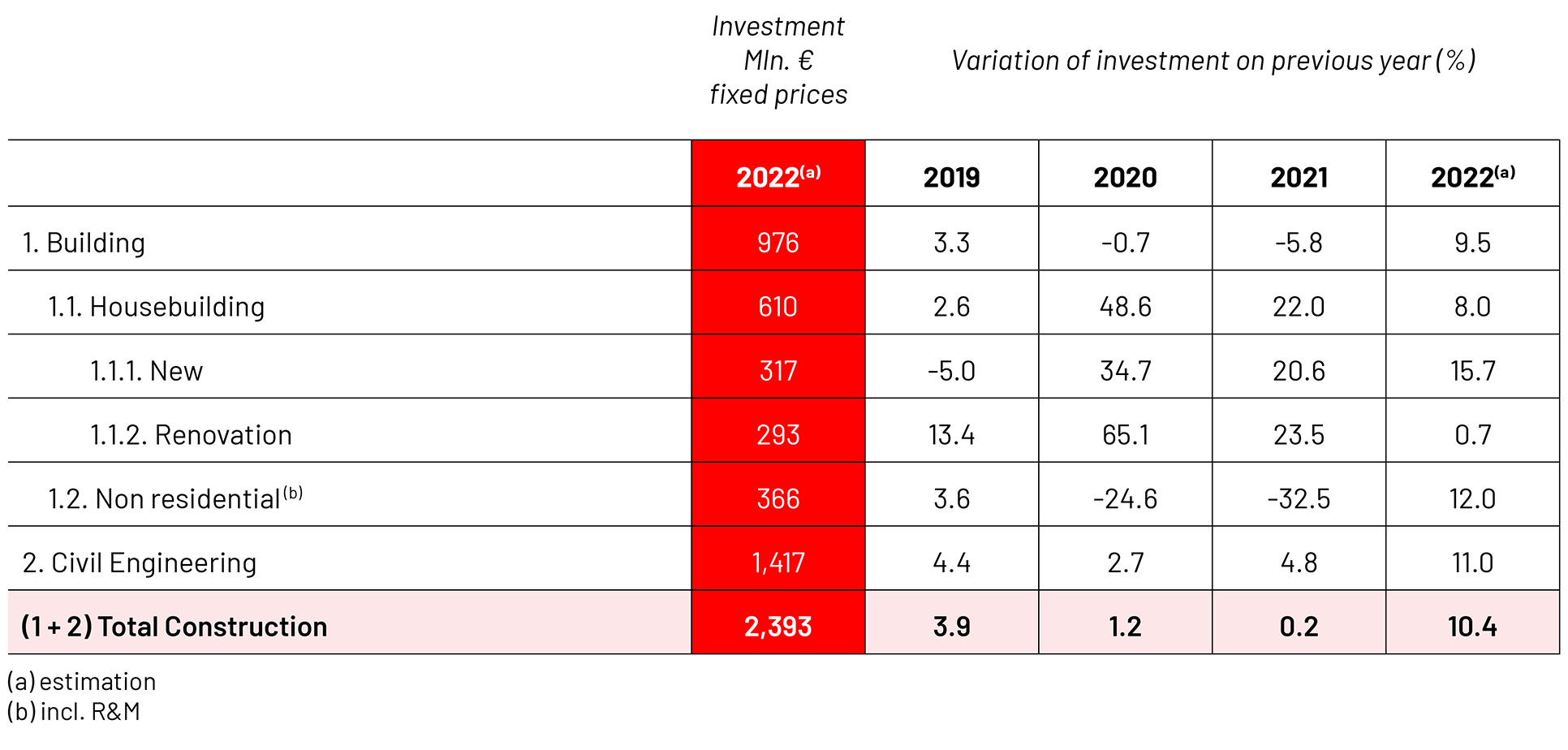

The value of investments in construction (part of gross fixed capital formation) in Slovenia amounted to EUR 6 billion in 2022, which is EUR 1.4 billion or 10.6% more in real terms than in 2021. The value of construction investment in Slovenia represents 0.3% of all construction investment in the EU-27. Investment activity was strong in 2022, mainly due to the increase in investment in buildings and structures, where government and housing investment increased. Investments in residential buildings increased by EUR 345 million in 2022, and in other buildings and structures by EUR 1,048.4 million in 2022. However, investment activity in the construction industry was characterized by rising input and output prices - increase in the cost of input raw materials and materials, as well as the increase in the cost of energy products and problems with the supply of materials. According to the share of gross construction investment to GDP, Slovenia stands out in the EU for its lower value - 10.1% of GDP in 2022 and 8.8% of GDP in 2021, compared to the share in the EU-27 countries of 11.6% in 2022 (11.2% in 2021). This is particularly evident in lower investment in residential construction (Slovenia: 2.7%, EU-27: 5.9% of GDP). In terms of public investment, growth is expected due to use of grants in the amount of EUR 2.1 billion, which Slovenia will receive under the National Recovery and Resilience Plan more intensively from 2022, as well as from the Cohesion Funds and other sources from the European budget for the period 2021 to 2027. Investment growth will be supported by additional EU funds from the Recovery Plan and the Resilience Mechanism.

The data on imports and exports of construction services are encouraging. In 2022, exports amounted to just under EUR 750 million, while imports amounted to EUR 250 million, which means that Slovenia construction services added EUR 500 million net exports to Slovenia’s GDP (0.9%).

The value of construction works was 22% higher in 2022 than in 2021 (2.6% higher in the EU-27). Growth was very high in 2022 after two years of stagnation, also due to the election year, when construction investment usually increases, and due to strong demand. In 2022, 6% fewer construction permits were issued for buildings (5% more for residential buildings and 15% less for non-residential buildings) than in 2021. More importantly, the floor area of buildings is expected to increase by 8% (at residential buildings by 11%, and non-residential buildings by 4%). With construction permits for buildings almost 4,800 apartments were planned in 2022, or by 11% more than in the previous year (the planned surface area increased by 6%). The growth of the construction works in 2023 is estimated at 10%. In the following years, construction activity will be stimulated by public investment. Growth will be significantly influenced by the country's investment activity, which will be supported by the EU Recovery and Resilience Plan, as well as by the Cohesion Funds and other sources from the European budget for the period 2021-2027.

Construction costs for new housing increased by 14.4% in 2022 (material costs by 21.8%, labor costs by 7.3%), compared to the same period in 2021. Price growth in the construction sector is also more pronounced by labor shortages.

Most construction companies cited high material costs as the main limiting factor (55% of companies; 1 p.p. more than a year ago), followed by a shortage of skilled labor (49%, 6 p.p. more than a year ago) and high labor costs (40%, +10 p.p.).

In the whole year, there were 73,045 persons in employment in the construction industry in 2022, which is by 7.8% or 5,283 persons more than in 2021. The number of persons in employment increased the most in specialized construction activities (+3,350 persons), in construction of buildings (+1,300 persons) and in civil engineering (+630 persons). The number of persons in employment continued to grow and in December 2022, there were 73,045 persons employed in the construction industry. The construction sector recorded strong growth, despite the fact that there is a great shortage of labor in this industry. The employment of foreign citizens is increasingly contributing to the overall growth of the working population. The share of foreign nationals in construction was 46.3% in the whole year 2022 and 43.3% in 2021. In the labor market, there is still a large excess of demand over supply of skilled workers in the labor market.

Prices of residential properties in Slovenia in 2022 were higher by 14.7% compared to the same period of the previous year. Prices for newly built dwellings increased by 7.2%, and prices for existing dwellings by 15.5%. The total number of transactions of dwellings in 2022 is gradually declining, and there were 10.2% fewer in 2022 than in 2021, and the total value of housing transactions decreased by 3.2% in this period. Office real estate prices have increased over the past three years, up 6% in 2022. The median selling price for office space in 2022 was 1,044 euros per square meter in Slovenia, and 1,671 euros in Ljubljana.

In the construction sector, confidence indicator in February 2023 is in positive territory by 20 p.p. (difference between positive and negative feedbacks). Year-on-year, the confidence indicator was lower by 8 p.p., but remained significantly above the long-term average, by 28 p.p.

Housebuilding

The value of construction works on buildings was 53% higher in 2022 than in 2021. On non-residential buildings it increased by 63%, and on residential buildings by 47%. The residential real estate market in Slovenia has already reached the peak of the growth cycle in 2022, with prices increasing mainly in larger cities. On the real estate market, we expect real estate prices to stagnate in 2023, despite the rise in production prices for new real estate, due to rising material prices and labor costs (the shortage of construction workers is high throughout the CEE). At the same time, financing conditions for financing large purchases will gradually deteriorate what will affect especially larger real estate (value above EUR 300,000). Tighter monetary policy and lower purchasing power of households will impact demand for new buildings.

GDP 2024

BILLION

POPULATION 2024

Total investment in construction in 2024

BILLION

Civil engineering

In 2022, the value of construction works in civil engineering went up by 14% compared to 2021. The growth of construction engineering projects will be stimulated by greater public investments in the field of transport infrastructure, especially the 2nd railway track to Koper-Divača, 3rd development axis, renovation of the railway infrastructure, renovation of national roads and cycle paths, construction and renovation of the electricity network.

Construction activity

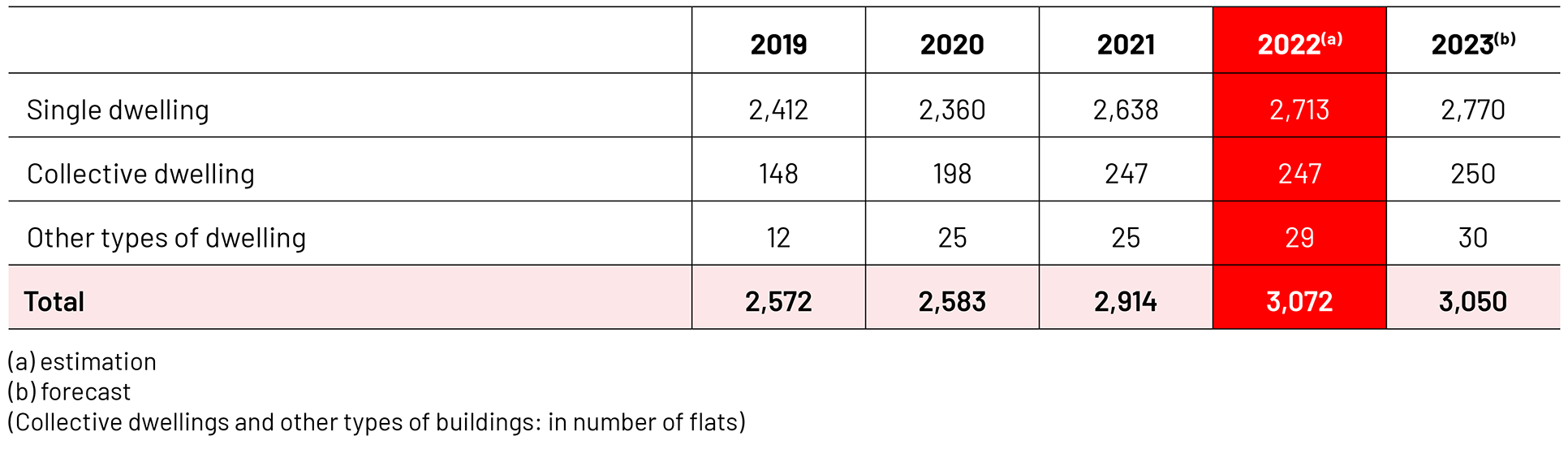

Number of building permits in residential construction