Overall construction activity

The Slovak economy rose by 2% last year, its progress was the fastest in the last three years. However, the construction industry experienced a more difficult period in 2024, when the entire sector production reached the amount of almost 7.5 billion euros. The sector's overall performance was not improved even by slightly increasing output in the last two months of the year. Overall construction production for 2024 ended with a 5% drop.

In 2024, all components of domestic production recorded a decline, especially the strongest component, domestic new construction with reconstructions and modernizations by more than 6% and also works on repairs and maintenance of buildings by almost 5%. The dominant construction of buildings decreased by more than 2% and there was also a drop of almost 12% in production of civil engineering. The construction sector again achieved a negative result for the second year in a row, while in 2023 it was only moderate by 0.2%.

In the short term, the new construction law may positively affect the result. After the new government took office, the adopted new Construction Act was revised, and its effectiveness was postponed. The comments on the new text of the Construction Act took place during the summer of 2024. The new Act was adopted at the end of 2024 and its effectiveness was set to begin on April 1, 2025. On the other hand, the government's consolidation policy will likely have a significant negative impact on the performance of the construction industry again.

Employment in construction increased slightly. The risk of labour shortages in the future persists.

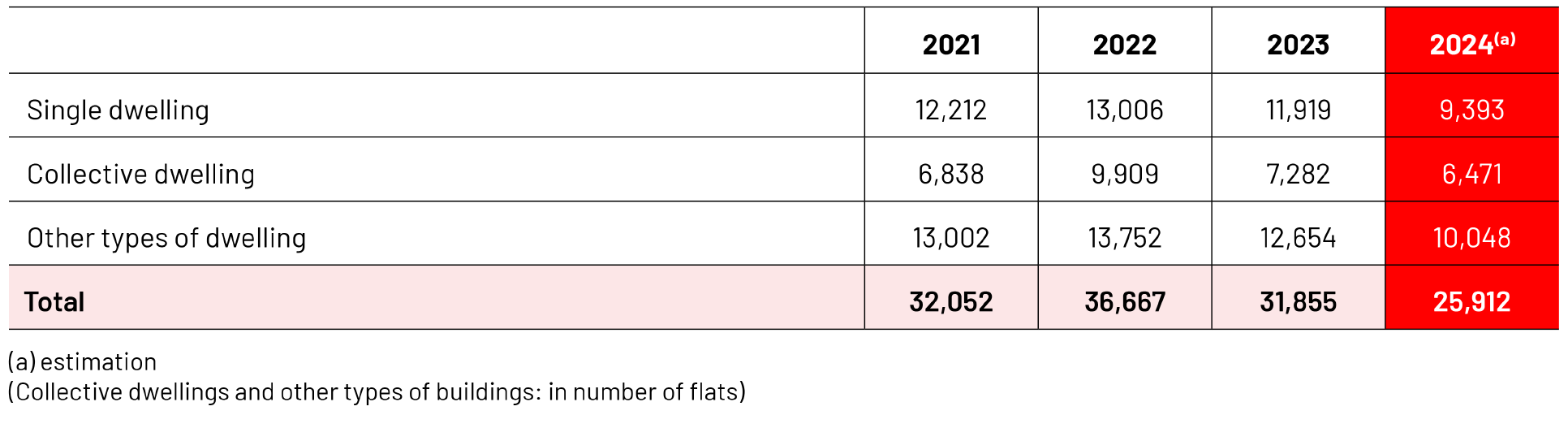

Housebuilding

In Slovakia, the number of completed dwellings in 2024 was the lowest in six years and dwelling construction was characterized by a general slowdown. Up to 3 out of 8 regions had worse figures than on average before the pandemic, and up to 7 regions were significantly behind the start of construction. The most significant slowdown was in Bratislava region, where the completion of dwellings decreased by 24% and the start of construction by up to 56% compared to the five-year pre-pandemic average. Based on the data showing that the start of construction dropped to an 11-year low, it is anticipated that these number of completed dwellings will decrease further in the coming years. A possible improvement in the situation could be brought about by investments in state or municipal rental apartments, which the state has been striving to build in recent years. The housing shortage is constantlymainly concentrated in economically developed regions.

By the end of 2024, 77.200 housing units were under construction in Slovakia, which was 2.7% less than at the end of 2023 and at the same time 3.2% more than the ten-year average.

The Home Renovation program continued to provide financial support in 2024 for renovations of family houses, mainly covering insulation, replacement of doors, windows or energy-saving technologies.

Non-residential construction

Non-residential construction showed lower year-on-year production in individual months during the year 2024. But this trend changed at the end of the year, when in the last three months, construction production increased by 1.7 to 15% compared to the same period last year.

In the private construction sector (industry, shopping centres, offices), the last year has been characterized by uncertainties due to tax impacts and economic consolidation, as well as persistent ambiguities affecting construction legislation, as the Construction Act is repeatedly amended.

GDP 2024

BILLION

POPULATION 2024

MILLION

Total investment in construction in 2024

BILLION

Civil engineering

The civil engineering segment experiences a continuous decline in the volume of production– the year-on-year difference represented a decrease of almost 12%. In the public sector, the main contracting authority in civil engineering is implementing state investments ratherslowly and that does not bring sufficient opportunities needed for construction works on engineering structures. The new public procurement in 2024 concerned the construction of new highways in Slovakia.

Prices of construction materials

After a significant increase in 2022-2023, the prices of some construction materials have stabilized and even decreased. This is especially true for wood and steel. Other materials are continuously increasing year-on-year. Prices have increased due to inflation or have been increased by energy prices, and this applies to basic building materials (bricks, cement). There was an abundance of building materials this year, commonly used ones in stock for immediate delivery, and those ordered were with a reasonable delivery time in weeks, which does not deviate from the EU average.

Data source: Statistical Office of the Slovak Republic and individual analyses of The Association of Construction Entrepreneurs of Slovakia

Number of building permits in residential construction