GDP 2024

€ 568

BILLION

BILLION

POPULATION 2024

5576660

Total investment in construction in 2024

€ 41

BILLION

BILLION

Construction activity

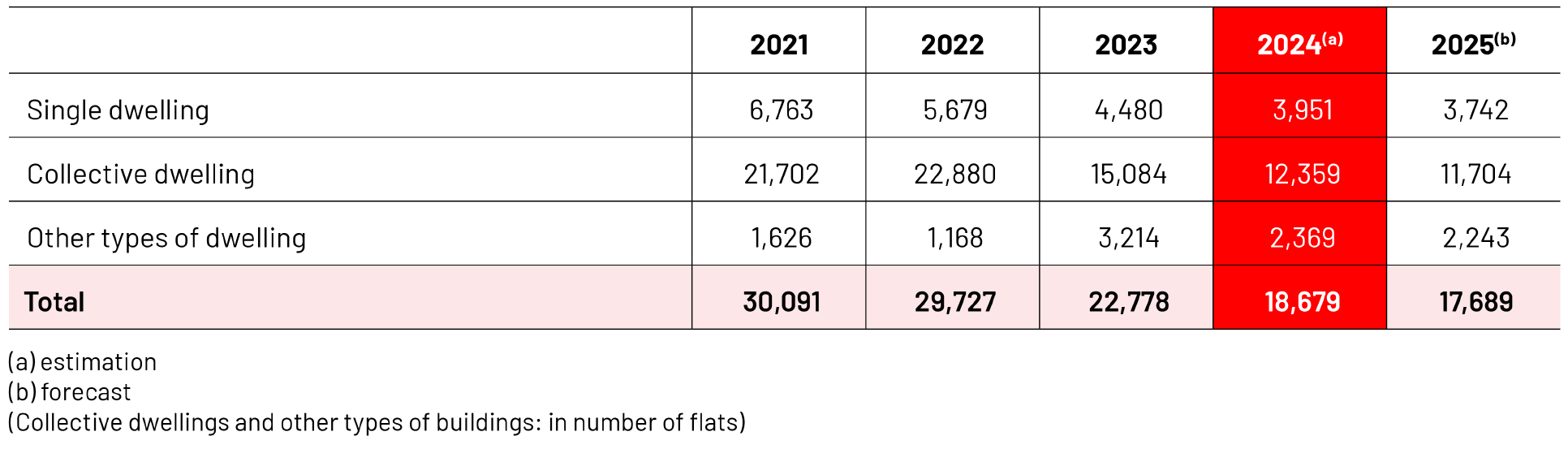

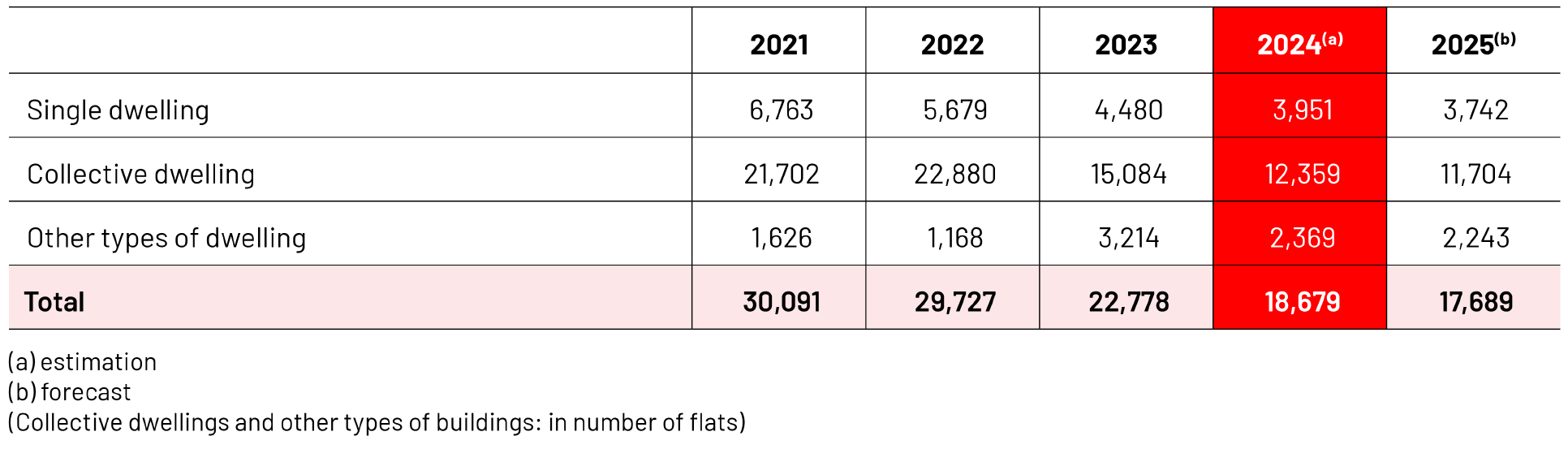

Number of building permits in residential construction

GDP 2024

POPULATION 2024

Total investment in construction in 2024