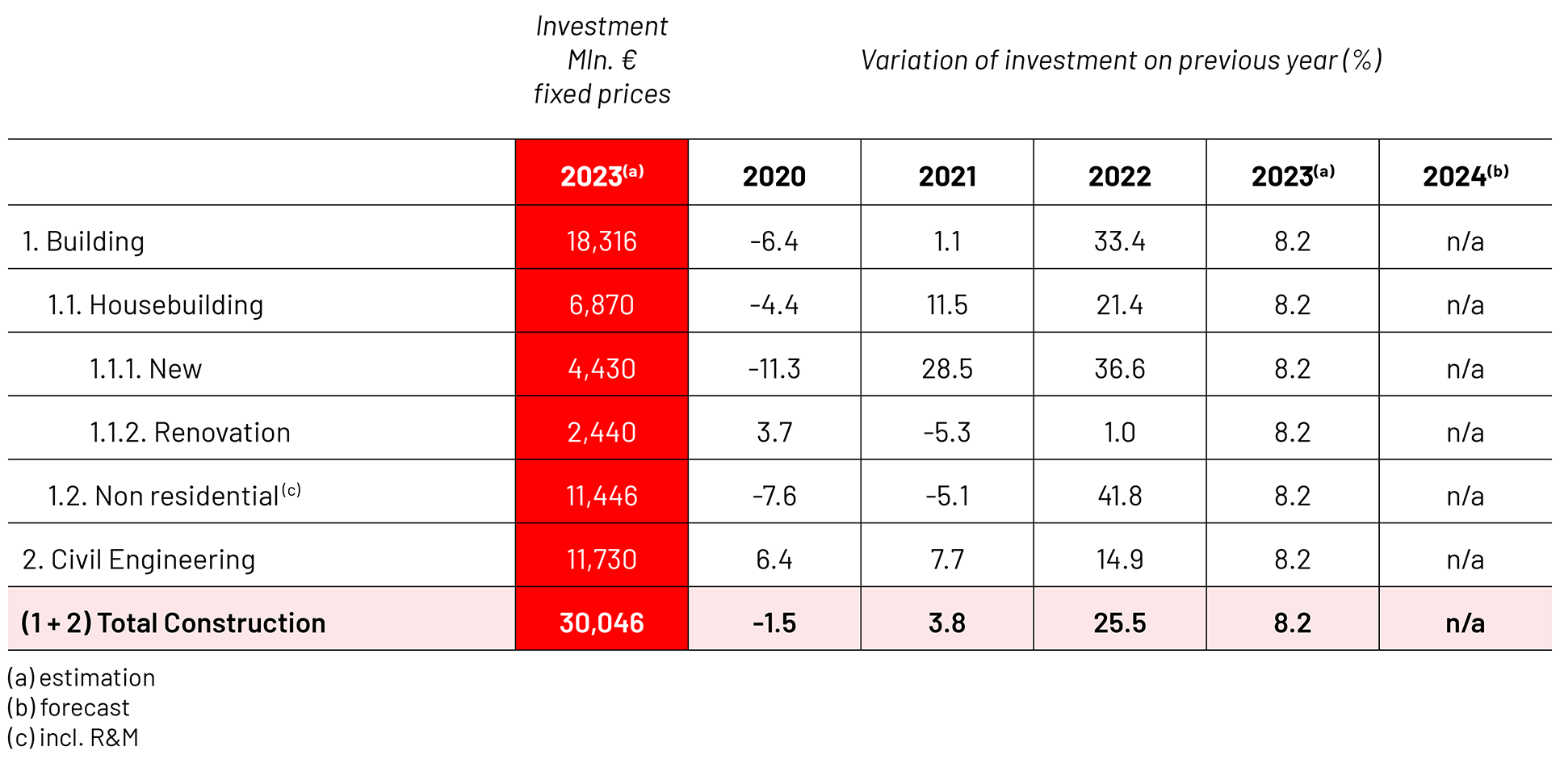

Overall construction activity

Construction is the sector of the Czech economy that was most affected by the economic crisis in recent years, until 2013. A short-term recovery took place in 2014 and 2015, when the first EU budget period ended and buildings financed by these funds were completed. It was not until 2017 that the trend of gradual growth returned, accelerating in 2018 and continuing in 2019. In 2020, despite favourable forecasts, construction output fell. Initially, production was not significantly affected by coronavirus epidemics, but later labourshortages, stagnating demand and administrative unpreparedness for construction began to manifest themselves. In 2021 and 2023, an extraordinary rise in the price of building materials added to the above problems, but production still increased year on year.

The stock of building orders and building permits is still at a good level, so at least modest growth can be expected.

However, the long-term forecast is very uncertain as there are a number of risks that could have a negative impact on future developments.

These include the impact of economic fluctuations and their manifestation in the tightening of public finances and, consequently, the need to reduce state budget spending on investment. Another important factor is the unsatisfactory quality of construction legislation, which is currently undergoing a demanding recodification process. This has a negative impact on the preparation of investments in buildings, both in the private sector and especially in the public sector, especially in transport infrastructure. One of the most risky factors is the lack of labourcapacity, due to the decline in the labour force and its minimal recovery.

Housebuilding

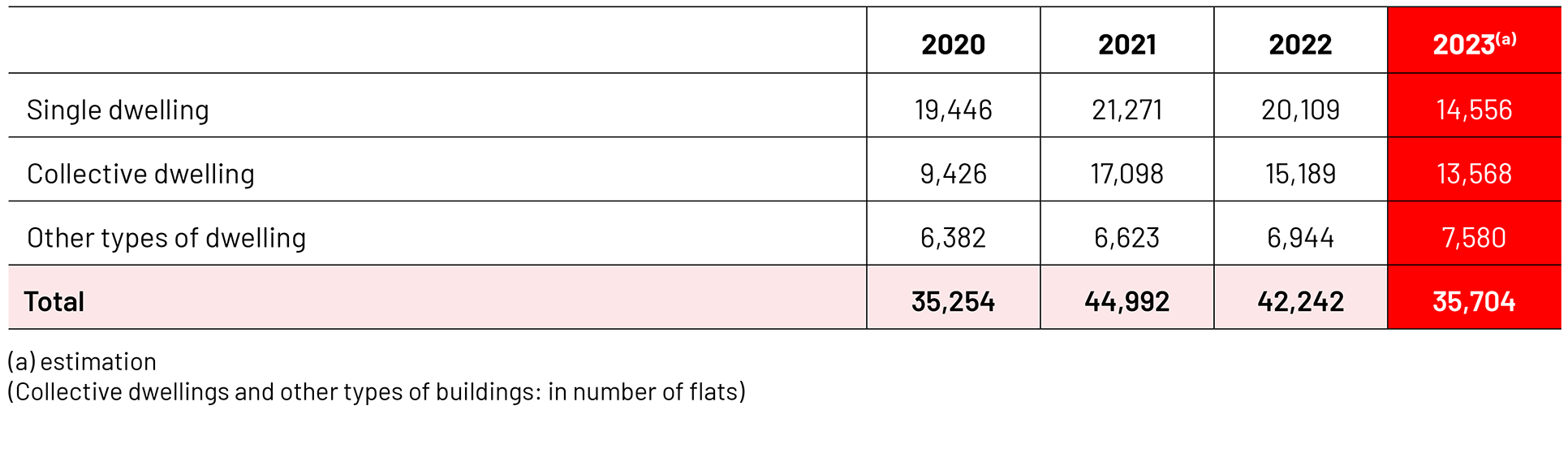

The evolution of residential construction - in terms of the number of dwellings completed and started - largely mirrors the evolution of the construction industry as a whole. The gradual increase since 2013 is much slower than the decline since 2007.

In 2019, the number of completed dwellings reached 36 thousand, but in 2020 the growth stopped due to the coronavirus epidemics. In 2021, there is a boom, particularly in the area of construction starts, and completions are around the same level as the previous year, which is not a good result given the low base.

Conversely, in 2022 the number of housing starts falls by 7.7% year on year, while almost 40,000 dwellings are completed, the most since 2007. In 2023, there is a decline in both categories of construction.

Due to the age of the buildings, the demographic and social composition of the population and the increasing demand for quality housing, the average annual demand for new dwellings was calculated at 37,000 per year. This was achieved only in the years 2007 - 2010. The trend towards a faster increase in the number of flats in multi-family houses is slowly growing, although the number of flats completed each year in single-family houses predominates.

According to the data for 2020 and 2022, the majority of family houses have a flat of the size 4+1 and a floor area of 90m2. The average number of flats in apartment buildings is 28, the size is 2+1 and the area is about 50m2.

Reconstruction, modernisation, repair and maintenance of dwellings also account for a significant proportion of output in this segment of construction. The number of new dwellings in the non-residential sector has shown a growing trend in recent years.

Attention is constantly being paid to improving the energy efficiency of dwellings. The proportion of newly completed dwellings that comply with categories A (extremely efficient) and B (very efficient) is increasing. The additional insulation of older buildings, especially those built using prefabricated panels, is also continuing at a very high rate. More and more attention is being paid to the construction of passive houses.

In the Czech Republic, 56% of private dwellings are in their own house, but a large proportion are also private dwellings in blocks of flats.

Non-residential construction

Non-residential construction stagnated until 2017, with some categories even showing a downward trend. The recovery started in 2018, when the number of completed buildings increased by 50%, across all construction categories. In line with this, the total area of completed buildings and their investment costs also grew. These were mainly administrative buildings and large shopping centres. There was also a steady increase in the construction of buildings for civic amenities - mainly schools, university campuses, healthcare buildings, sports and cultural facilities, including their repair, maintenance and energy efficiency improvements. This trend affects not only large cities, but also regional ones.

The economic recovery has also influenced the reconstruction and expansion of industrial buildings and warehouses, as well as the development of new areas, including a complete infrastructure network. Much attention is also being paid to the completion of buildings and facilities to ensure compliance with increased environmental protection requirements.

GDP 2023

BILLION

POPULATION 2023

Total investment in construction in 2023

BILLION

Civil engineering

Between 2016 and 2017, the civil engineering sector recorded a significant decline in the volume of work performed. The reason for this is that the public sector, i.e. the main contracting and awarding authority in civil engineering, very significantly reduced its orders from the usual 45-50% of all orders to only 32% in 2017. The situation improved in 2018, and the positive trend continued in 2019 and 2020. The year 2021 brought stagnation and last year growth resumed.

However, problems remain due to the negative impact of coronavirus epidemics and are most noticeable in transport infrastructure, especially motorway infrastructure. This is due both to land acquisition and to obstruction by civil initiatives. Both are the result of imperfect legislation. The construction law is still in the process of being approved and its further adoption should bring a significant improvement. The situation is better for the construction and modernisation of railway infrastructure, where work is carried out on the investor's own land.

Prices of construction materials

Prices of construction products - the development of prices of construction products in the Czech Republic in 2022 increased on average by 30 to 40% compared to the previous period. In 2023, prices continued to rise, but production increased on a year-on-year basis.

Per cent variation of investment in real terms of previous year

Number of building permits in residential construction