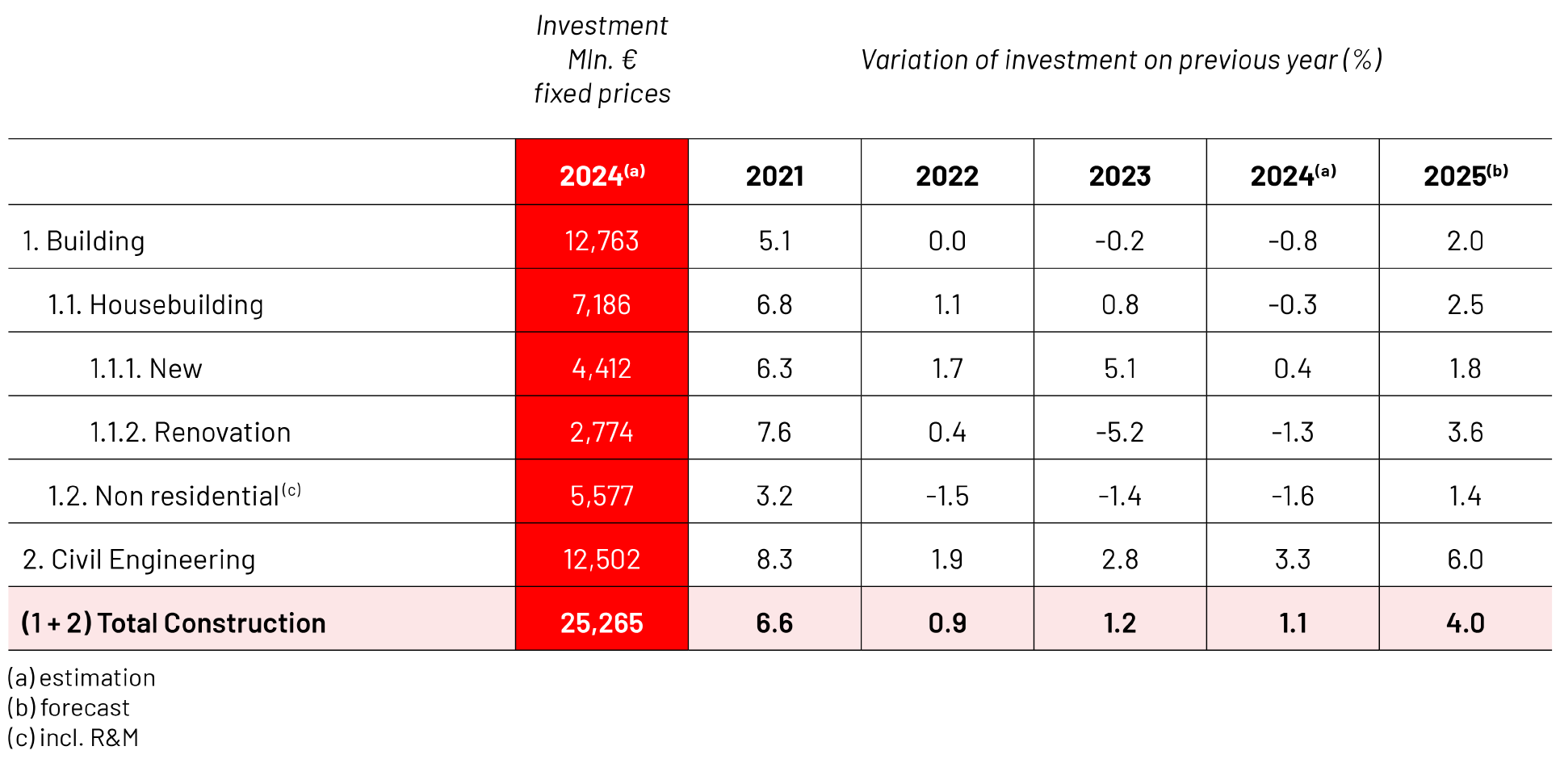

Overall construction activity

In 2024, the Portuguese economy recorded a GDP growth of 1.9. This performance was mainly driven by the growth in private consumption, supported by a context of tax relief, wage and pension increases, and a resilient labour market. However, this growth represents a slowdown compared to previous years, reflecting an international context marked by geopolitical tensions in Europe and the Middle East, the slowdown of major European economies (notably Germany and France), and the effects of high interest rates.

Private consumption remained the main driver of economic growth, increasing by 3.2%. The labour market continued to show resilience, with the unemployment rate standing at 6.4%, a 0.1 p.p. decrease compared to 2023, and job creation in several sectors, including construction.

Investment (Gross Fixed Capital Formation) grew by 2.3%, driven primarily by public investment supported by the implementation of projects funded by the Recovery and Resilience Plan (PRR – Plano de Recuperação e Resiliência) and Portugal 2030 (EU Cohesion Policy framework). In contrast, private investment remained moderate due to high interest rates and uncertainty in the international economic environment.

According to estimates, the Gross Production Value of the Construction Sector reached €22.1 billion in 2024, representing a real growth of 3.0%. This performance was achieved despite ongoing challenges such as the shortage of skilled labour, bureaucratic burdens, and volatility in energy and construction material costs.

Inflation, as measured by the Consumer Price Index, dropped significantly to 2.4% in 2024 (down from 4.3% in 2023), benefiting from more stable energy prices, raw material costs, and normalized supply chains.

In 2024, the prices for the different materials necessary for Construction activities increased by 3.3%, after the increases of 3.9% in 2023 and 12.2% in 2021.

The number of authorised construction companies increased by 7.8% in 2024, reaching approximately 69.4 thousand, due to growth in both active licences (37.7 thousand) and certified entities (31.6 thousand).

The total amount of credit granted to Portuguese companies stood at €72.6 billion, a decrease of 0.9% compared to the previous year. In the Construction and Real Estate sector, the decline was 0.6%, with total credit amounting to €15.7 billion. Notably, non-performing loans in the sector decreased by 13.3%, to €406 million.

Cement consumption rose by 4.3%, totalling 4.074 million tonnes – the highest figure since 2011. Employment in the Construction and Real Estate sector increased by 1.5%, corresponding to around 9,000 new jobs. Nonetheless, registered unemployment in the sector increased by 6.5%, reaching 29.4 thousand in December, or 8.8% of total registered unemployed.

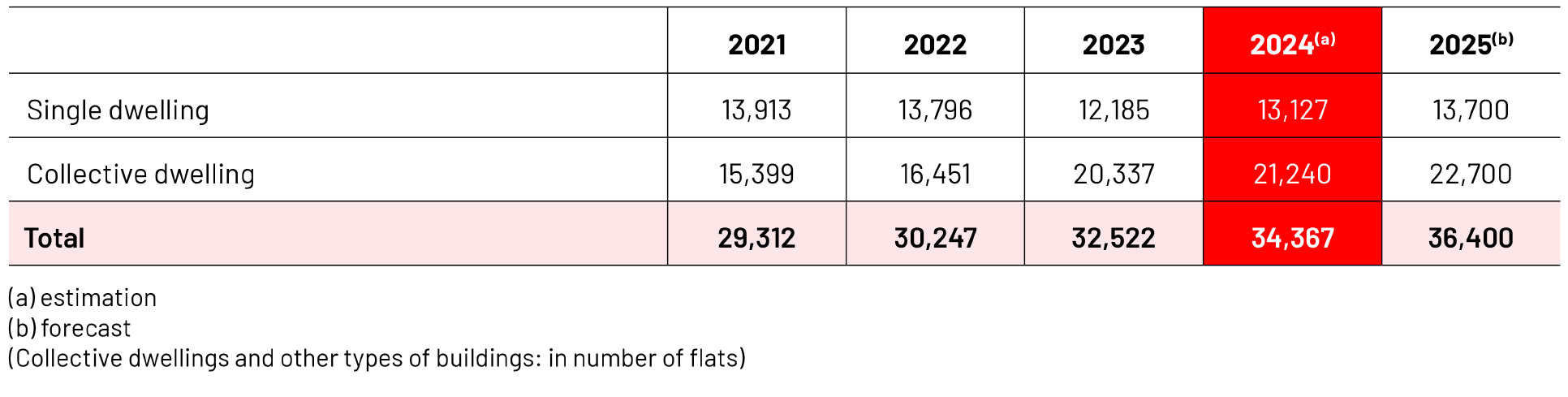

Housebuilding

In 2024, the residential real estate market showed clear signs of recovery after a downturn in 2023. The number of family dwelling transactions increased by 14.5%, reaching 156,325 units. Of these, 79.6% were existing homes (+14.8%) and 20.4% were new homes (+13.4%).

The transaction value totalled €33.8 billion, 20.8% higher than in 2023. Prices continued to grow significantly, with the House Price Index increasing by 9.1% in 2024. While this reflects strong demand in the housing market, the pace of price growth raises concerns about long-term affordability and the sustainability of current valuation trends. Existing home prices rose by 9.7%, while new home prices rose by 7.5%.

The average annual growth in bank appraisal values was 8.5%, with a sharper rise of 13.7% in December, reaching a median value of €1,747/m². Apartment prices rose by 15.2%, and house prices by 9.3%.

The stock of mortgage loans grew by 3.6% year-on-year, totalling €102.4 billion. New housing loans reached €17.8 billion in 2024, a significant increase of 37% compared to 2023, despite a 9.9% increase in non-performing mortgage loans (still at historically low levels).

Building permits for new dwellings increased by 4.9%, totalling 34,117 units – the highest number since 2008. The North region stood out, with 15,506 licensed dwellings, accounting for 45% of the total.

The total number of licensed building and rehabilitation projects increased by 7.6%, with new constructions rising by 8.2% and rehabilitation works by 6.0%.

Forecasts for 2025 suggest a 2.5% real growth in residential construction, though housing supply is still expected to fall short of demand.

Non-residential construction

In 2024, the production of non-residential buildings grew by a modest 0.5%, reaching around €4.8 billion. This was the least dynamic segment within the construction sector.

Licensed area for new non-residential buildings reached approximately 4.2 million m². Commercial buildings accounted for the largest share, exceeding 1.2 million m², followed by industrial buildings (around 900,000 m²) and general-use buildings (around 800,000 m²).

In 2025, non-residential building production is expected to grow between 0% and 2%, depending on the recovery pace of private investment and broader economic conditions.

GDP 2024

BILLION

POPULATION 2024

Total investment in construction in 2024

BILLION

Civil engineering

Civil engineering remained the most dynamic segment of the construction sector in 2024, with a 5.1% increase in real production, strongly driven by public works.

According to data from the Portal Base, the public works market reached historic highs. The value of tenders launched increased by 39% compared to 2023, totalling €8.4 billion. The total value of contracts signed rose by 32%, reaching €4.9 billion. There were 5,255 public tenders launched (+4.2% in number), with an average value of €1.55 million. High-value contracts (over €3.2 million) accounted for 68% of the total tendered amount.

Among signed contracts, public tenders accounted for €4.06 billion (+39.7%), with an average value of €886,545. Direct award and prior consultation procedures amounted to €639 million (+15.4%).

In 2025, civil engineering is expected to grow between 5% and 7%, maintaining its key role in the sector’s performance. This outlook is supported by increased public investment, particularly under the PRR and Portugal 2030 programmes.

Prices of construction materials

In 2023, there were large differences in the evolution of the prices of the different materials required for construction activities. On average, however, the variation in the construction cost index increased by 5.3% in the first three quarters of the year, after strong increases of 13.3% in 2022 and 9.7% in 2021.

Construction activity

Per cent variation of investment in real terms of previous year